How to categorize and confirm NIF invoices

Just a few more months and then it's time again for the tax return in Portugal. But the preparation...starts a little earlier! In this article, I'll explain to you how the payments linked to your NIF in 2022 will appear under the correct category so they will be confirmed!

With almost every payment you make, you can provide your NIF. This will link the payment/invoice to you and can give you some money back when you file your tax return. Before you file your tax return you have to make sure that the payments (the ones that are linked to your NIF) are registered under the correct category. Many payments are automatically registered under the correct category but for some you have to do this yourself! You must have done this before February 27!

12 categories

Despesas Gerais Familiares (household expenses)

Most expenses will be included in this category, such as clothing, groceries, gas, water, telephone bills, etc. For this category there is a maximum of 250 euros you can get back. If you manually add the correct category, you choose ´outros´.

Saúde (health)

Bills for medical products and services that fall under the standard VAT rate (23%) won´t be on ´pending´ or automatically catorized as health. Since medical products and services are only deductible at 23% if they have been obtained with a medical prescription. You must therefore enter this manually.

Educação (education):

For this category, almost anything related to education applies as long as it has a VAT of 6% or is completely VAT free. School supplies such as pens and notebooks have a VAT of 23% and therefore don´t fall under the educação category. Tuition doesn´t normally appear on the app but only at the end of February on the AT's website (Autoridade Tributária, Portal das Finanças). You don't have to fill this in yourself.

Habitação (residence)

This category include rent. Don't worry if this doesn't appear in your app! Often these expenses won't appear on the AT's website until March/April.

Lares (special homes)

This category includes nursing homes, home care and other institutions that provide support. The public homes won´t always provide an invoice and therefore may not appear in the app. You can always find these payments later on the AT's website.

Reparação de Automóveis (Auto repair and maintenance services)

Expenses of auto repair and maintenance services.

Reparação de Motociclos (motorcycle repair and maintenance services)

Motor repair and maintenance services.

Restauração e Alojamento (restaurants and lodging)

Hotel stays and expenses in a restaurants, bars, canteens, etc. For this category (and for Cabeleireiros, Reparação de automóveis/motociclos, Ginásios and Atividades veterinárias), the amount is calculated as follows: On your receipt you will see the amount of VAT (6%, 13% or 23%, in Madeira and the Azores different VAT rates apply) and from that amount you may then deduct 15%.

Cabeleireiros (hairdresser)

You can also provide your NIF when visiting the hairdresser or beauty salon!

Atividades veterinárias (veterinary activities)

This category includes the costs you spend on the medical care of (domestic) animals. Like a visit to the veterinarian and medicines for animals.

Passes Mensais (monthly passes for transportation)

If you have a monthly pass for public transport in Portugal, such as the Navegante Metropolitano, the cost falls under this category.

Ginásios (gyms)

Expenses you spend at the gym or other sports activities.

Categorizing and confirming the payments

To confirm the payments you´ll need to put them under the correct category. There are two ways:

- Through the website https://faturas.portaldasfinancas.gov.pt/

- Through the app E-fatura

Through the app E-fatura

-

1. Download the app and log in

Download the app and log in with your NIF and Portal das Finanças password.

-

2. Choose the correct year and check out the overview

You get an overview of payments to which your NIF is linked. If you see the message ´tem . fatura(s) pedentes" it means that you still have some invoices that have not yet been categorized. Click on the notification.

-

3. Click on the invoice

Click on the invoice description and then ´Classificar Faturas´

-

4. Select the correct category

Select the correct category and click on confirmar. The invoice disappears from the list and is now under the selected category!

Through the website

-

1. Visit the website

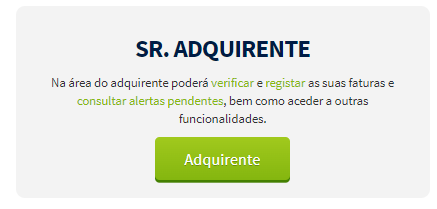

Go to https://faturas.portaldasfinancas.gov.pt/ and click on Faturas. Scoll down and click on Sr. Adquirente

-

2. Check for invoices with no category

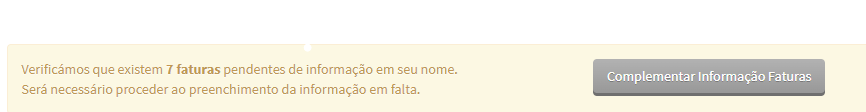

Check if the year is 2022.

If there are invoiced linked to your NIF but haven't yet been confirmed, you will get a notification. You can click on the notification (Complementar Informação Faturas) and then on the symbol of the correct category. Then click guardar so that it is saved.

-

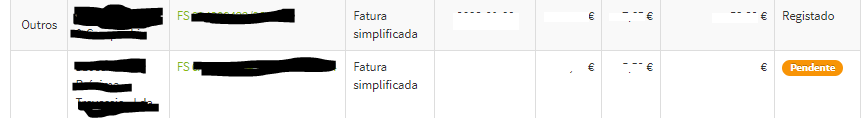

3. Check the rest of the invoices and add a category

Want to make sure you haven't missed a payment?

Click Verificar Faturas so you get another list of all payments linked to your NIF. If something still needs to be confirmed it says pendente.

Click on the link of the invoice number (starts with FS) to get more information about the invoice. Scroll down and click Alterar, choose the correct category and click guardar so it will be saved!

Repeat this with all invoices until everything is confirmed so you are sure you don't miss an invoice! TIP: download the app and check occasionally throughout the year your invoices.

.

All Rights Reserved | ANNEMINHA